Activity-based accounting makes it possible to assign an indirect. Resources are assigned to activities and activities to cost objects.

Activity Based Costing Arrow Diagram Http Www Poweredtemplate Com Powerpoint Diagrams Charts Ppt Business Models D Diagram Chart Powerpoint Charts Powerpoint

This method paints a clearer picture of where a companys money is going and can help the business to trim expenses or more accurately price its goods.

. It is a process of tracking resource use and pricing final outputs. By cutting costs you bring down your expenses. Therefore this model assigns more indirect costs overhead into direct costs compared to conventional costing.

Activity based costing refers to cost attribution to cost units on the basis of benefits received from indirect activities. The primary activity based costing uses includes seeing which activities are important and which you can do without. The goal of activity-based costing is to assign specific resources to objects.

Activity-based costing ABC is a costing method that assigns overhead and indirect costs to related products and services. Activity-based costing or ABC is popularly referred to as a method of costing whereby overhead costs are assigned to products and services. Activity based Costing ABC is a systematic cause effect method of assigning the cost of activities to products services customers or any cost object.

Activity-based costing also known as ABC costing refers to the allocation of costs charges and expenses to different heads or activities or divisions according to their actual use or on account of some basis for allocation ie. Cost pool and cost drivers are taken care of in this method. It therefore keeps a close connection between the activity that drives the cost and the cost itself.

Drawbacks to expect when using the ABC approach include. Cost driver rate which is calculated by total cost divided by total no. Activity-Based Costing is a method of assigning indirect and overhead costs to each of your products or services - giving you a better idea of their actual costs.

Of activities to arrive at a profit. Activity-based costing ABC is a methodology for more precisely allocating overhead costs by assigning them to activities. ABC is based on the principle that products consume activities.

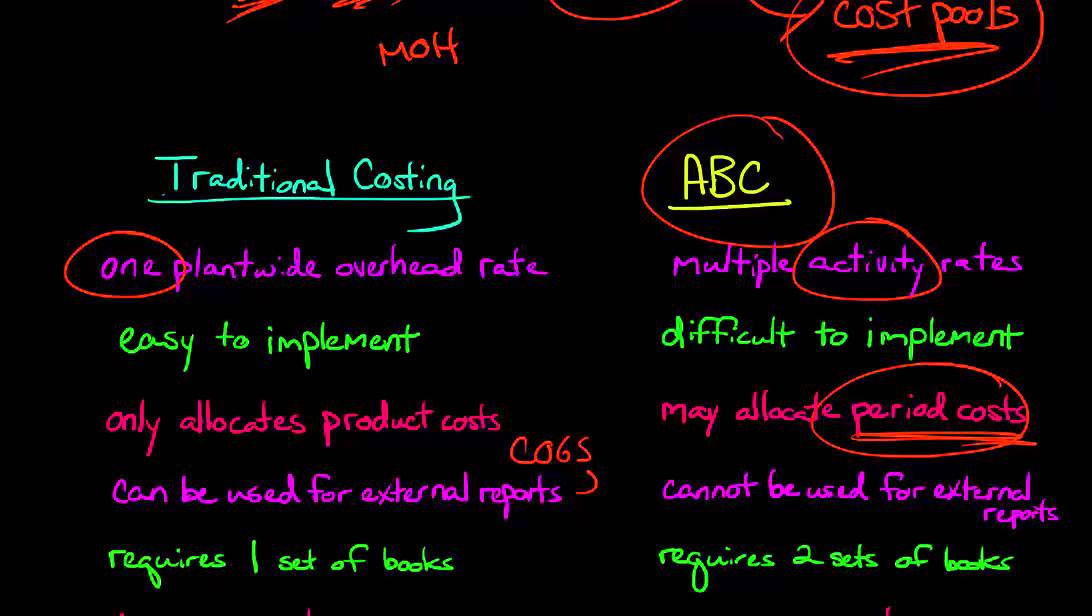

On the other hand absorption costing is the conventional costing approach. It is that costing method in which costs are first attributed to activities and then to products. Unlike traditional costing methods it assigns the cost of each business activity to each product and service.

ABC works best in complex environments where there. Indirect costs might include overhead like utilities and salaries. Activity-based costing also known as ABC is a method to determine the total costs associated with creating a product.

When compared to traditional costing methods the activity based costing system is. It helps the management identify cost activities and cost drivers. Page 8 - ABC example - 502.

Activity-based costing is a comprehensive cost allocation method. Activity-based costing or ABC seeks to improve the quality of the calculation by using the amount of activity involved in making the item as a basis for absorbing the overheads. Activity Based Costing is a method that companies use to arrive at an accurate cost or price of the product.

ABC method serves several purposes including product costing pricing profitability and customer profitability analysis. This method can be very budget-friendly if used properly. AN ACTIVITY-BASED COSTING SYSTEM 5-3 ABCs 7 Steps Step 1.

ABC assigns costs to activities associated with each step of the manufacturing process such as employees testing a product. Activity-based costing is an accounting method that assigns costs to the different activities involved in making a product in order to allocate a companys funds in a fair way. In simple terms activity-based costing helps you see how your products and services related to your overhead costs.

This costing system is based on the premise that activities are responsible for the incurrence of costs and create the demands for resources. The latter use cost drivers to attach activity costs to outputs. CIMA Official Terminology describes activity-based costing as an approach to the costing and monitoring of activities which involves tracing resource consumption and costing final outputs.

Activity-based costing is a costing method that focuses on activities performed to produce products. Identify the direct costs of the products. Select the activities and cost-allocation bases to use for allocating indirect costs to the products.

Identify the products that are the chosen cost objects. Activity-based costing is a process of calculating the cost of products that accounts for indirect costs. This method of costing recognizes that a relationship exists between the costs incurred and every other activity going on in the business.

ABC costing provides more relevant and detailed information as compares to absorption costing which uses direct material hour rate or labor hour rate for calculating a rate that could be used for allocation of overheads. Once costs are assigned to activities the costs can be assigned to the cost objects that use those activities. Identify the indirect costs associated with each cost-.

This accounting method of costing recognizes the relationship between costs overhead activities and manufactured products assigning indirect costs to products less arbitrarily than traditional costing methods. Activity based costing ABC is a costing method that identifies activities in an organization and assigns the cost of each activity to all products and services according to the actual consumption by each. It is a very effective tool and can help the organization to reach at a fair allocation of the overheads.

Traditional cost systems allocate costs based on direct labor material cost revenue or other simplistic methods. The system can be employed for the targeted reduction of overhead costs.

Pin On Strategy Marketing Sales

Abc Accounting Model Visual Charts Ppt Template Of Activity Based Costing Presentation Accounting Cost Accounting Presentation Deck

4 2 Activity Based Costing Method Managerial Accounting Managerial Accounting Revision Guides Activities

Activity Based Costing Abc In Excel Abc Activities Activities Abc

Unit 5 Activity Based Costing Study Objectives Recognize The Difference Between Traditional Costing And Act Cost Accounting Powerpoint Presentation Education

Activity Based Costing Abc Accounting And Finance Cost Accounting Financial Management

Activity Based Costing Accounting Principles Accounting And Finance Financial Strategies

3d Activity Based Costing Donut Diagram Http Www Poweredtemplate Com Powerpoint Diagrams Charts Ppt Process Diagrams Powerpoint Charts Diagram Diagram Chart

Activity Based Costing Abc Activities Activities Infographic

Infographic Activity Based Costing Ca Student Blog Education Icas Activities Infographic Education

Activity Base Costing Abc Details Knowledge Of What Is Activity Base What Activities Activities Abc Activities

Activity Based Costing Abc Vs Traditional Costing Activities Cost Accounting Traditional

Activity Based Costing Activities Accounting Principles Cost Accounting Pool Activities

General Activity Based Costing Explanation Video Managerial Accounting What Activities Activities

Cost Hierarchy Meaning Levels And Example Accounting Education Accounting And Finance Accounting Basics

Activity Based Budgeting Budgeting Accounting Principles Financial Management

What Is Behind The Activity Based Costing Activities What Activities Base

Cost Management Plan Example Templates Cost Accounting Abc Activities Key Performance Indicators